How to use different VAT rate for different products in orders

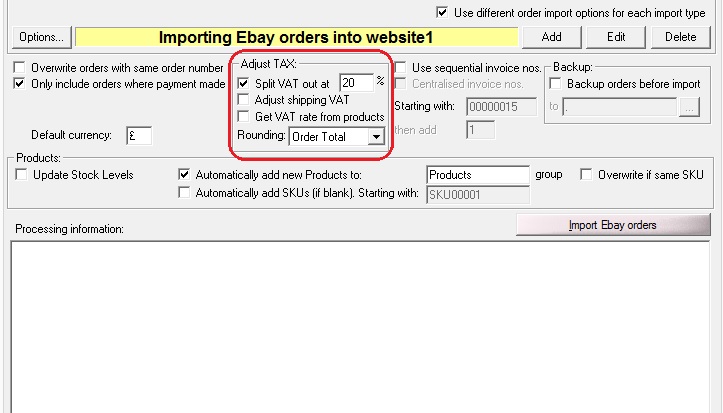

This is done by under the Import Orders menu under Adjust TAX, tick Split VAT out at and type in your value (e.g. 20%), This is shown below.

However some of the products in an order may have different VAT rates (e.g. books).

To use a different VAT rate from some items you should create a product (in Product Management) and set its VAT rate to the required rate.

1. This is done by clicking Products->Manage, then selecting the product with the different VAT rate.

2. Double Click on the product and select the Main Details tab.

3. Enter the VAT rate for the product in the VAT Rate field.

4. Click OK

5. When importing products you should tick Get VAT rate from products from the Adjust TAX section of the Import Orders menu.

Related Articles

How to import some of my products with a 0% VAT rate

For Ebay, Amazon, Actinic Online, Paypal, Magento, ekmPowershop, Pinnacle Cart, Other Shopping Carts (that use the OSOP format), Shopify, Tesco Direct, Groupon support the Get Tax Rate from Products option when importing orders. This allows you to ...After activating Amazon VAT calculation, imported Amazon orders show the wrong VAT

To show the correct VAT use the following approach: 1 Open the Import Orders dialog ( File->Import and Export->Import Orders menu option) 2 Select the Amazon import type 3 click on the Options button 4 Tick the Order prices include Tax (VAT), using ...How to automatically link products with slightly different SKUs from different sales channels

If you want to share stock over different sales channels you can import products from different sales channels and if the SKU is the same they will automatically be linked. The details for the links is shown on the Order Type SKUs tab on each ...How To Import Products From CSV File into One Stop Order Processing

The following guide explains how To Import Products From CSV File This feature is available in the Professional, Premium and Managed subscriptions of One Stop Order Processing. To import products from a CSV file you will need to make sure that you ...How to use different Account References when importing into Sage

The Sage view, by default, exports all orders into the WEB Account. If you use different currencies and want to put each currency into different accounts you can use the following default value of the Account Reference field to be : X[%Grand ...